ABC Pattern .328 1.27: Decoding Market Trends for Better Trading Decisions

abc pattern .328 1.27 In the ever-evolving landscape of trading, making informed decisions is essential for maximizing profits. One of the prominent patterns traders frequently examine is the ABC pattern, known for its straightforward structure and predictive capabilities. Its simplicity makes it a favorite among traders, especially when paired with Fibonacci retracement levels, specifically the .328 and 1.27 ratios.

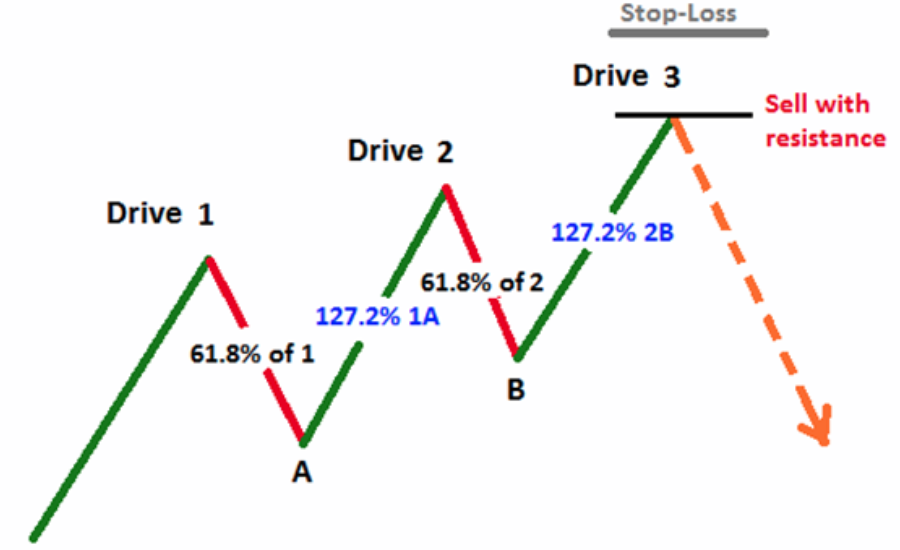

The ABC pattern consists of three key points: A, B, and C. The journey from point A to point B marks the initial price move, while the transition from point B to point C indicates a corrective phase. This pattern highlights potential reversals and helps traders anticipate future market movements.

When integrating Fibonacci ratios, the .328 level often serves as a crucial support point during price corrections, suggesting a potential rebound. Similarly, the 1.27 extension level can indicate a target price for profit-taking. By recognizing these levels within the context of the ABC pattern, traders can enhance their market analysis and make more strategic decisions.

Understanding and effectively applying the ABC pattern, along with Fibonacci levels, empowers traders to navigate the complexities of the market with greater confidence and precision.

abc pattern .328 1.27: A Key Indicator in Trading

The ABC pattern, characterized by the Fibonacci ratios of .328 and 1.27, is a significant trading formation that signals potential price reversals in the market. Comprising three essential points—A, B, and C—this pattern is closely monitored by traders as it highlights crucial price levels that can inform trading strategies.

Point A signifies the initial peak or trough in a price trend, marking the starting point of the formation. Following this, price action often retraces to point B, indicating a corrective movement within the trend. As the pattern unfolds, point C emerges, typically representing either a reversal in the trend or a continuation of the existing direction. By grasping the ABC structure, traders can make more informed decisions based on analytical data rather than relying on intuition alone. This understanding also reveals strategic opportunities for entering and exiting trades.

The effectiveness of the ABC pattern is amplified when paired with Fibonacci ratios. By analyzing the .328 and 1.27 levels, traders can identify potential zones of support and resistance, enhancing their insights into market dynamics. The combination of Fibonacci analysis and pattern recognition provides traders with a robust framework for navigating the complexities of the financial markets, ultimately leading to more strategic and calculated trading approaches.

Fibonacci Ratios: A Foundation in Trading

The renowned Italian mathematician Leonardo of Pisa, better known as Fibonacci, introduced a series of ratios that have influenced both mathematics and the natural world since the 13th century. His influential work, “Liber Abaci,” presented a sequence of numbers that continues to captivate and inspire analysis across various fields.

The Fibonacci sequence begins with the numbers 0 and 1, with each subsequent number being the sum of the two preceding ones. This sequence manifests in various forms in nature, from the arrangement of flower petals to the spirals of seashells and the structure of pine cones. These occurrences reveal the inherent beauty of mathematical principles woven into the fabric of the natural world.

In the realm of trading, Fibonacci ratios became crucial as traders sought methods to identify important price levels for both retracement and extension. The most commonly used ratios derived from this sequence include .236, .382, and .618, often referred to as the golden ratio. These ratios have become indispensable tools for traders aiming to anticipate market trends and make informed trading decisions, providing a quantitative approach to understanding price movements in financial markets.

Enhancing Your Trading Strategy with Fibonacci Levels

Integrating Fibonacci levels into your trading strategy can significantly improve your decision-making process once you grasp the foundational concepts. Start by pinpointing a notable price movement on your asset’s chart, such as a peak or trough. This pivotal swing serves as the basis for your analysis.

After identifying these critical points, measure the distance between them. This measurement will provide you with a reference point for subsequent calculations. With this baseline established, apply the key Fibonacci ratios: 23.6%, 38.2%, 50%, 61.8%, and occasionally 78.6%. By multiplying the distance you’ve recorded by these ratios, you can uncover potential support and resistance levels within the market.

To further refine your analysis, add or subtract these calculated values from your initial point, depending on the direction of the price movement—whether it is trending upwards or downwards. This approach allows you to identify potential areas where price corrections might occur, equipping you with valuable insights for making informed trading choices.

The Importance of .328 and 1.27 Fibonacci Ratios in Trading

The .328 and 1.27 Fibonacci ratios are essential tools in the trading arena, serving as critical indicators of potential market reversal points. These ratios emerge from mathematical relationships that are not only applicable in financial markets but also resonate throughout nature, making them particularly intuitive for traders to implement.

The .328 ratio indicates a retracement of approximately 32.8% from an initial price movement. This modest pullback often suggests a temporary pause before the trend resumes, providing traders with a strategic opportunity to assess buying or selling prospects based on current market conditions.

On the other hand, the 1.27 ratio signifies an extension that surpasses the original price movement by about 27%. This ratio is invaluable for predicting future price targets, especially when market momentum begins to shift.

Incorporating these Fibonacci ratios into your trading strategy can enhance your decision-making during periods of market volatility. A solid understanding of how these ratios correlate with price fluctuations is vital for capitalizing on emerging trends. By identifying these levels, traders can better navigate the complexities of the market and make more informed choices.

Mastering Fibonacci Ratios for Enhanced Trading

While understanding Fibonacci ratios is a crucial first step in effective trading, integrating them into a comprehensive strategy is vital for unlocking their full potential.

Start by identifying key support and resistance levels on your charts, as these are often the points where price reversals take place. Fibonacci retracement levels can provide valuable insights into these critical zones, helping you anticipate market movements.

Pay close attention to prevailing market trends. When a trend coincides with a Fibonacci level, it often signals a greater probability of either a reversal or a continuation, presenting traders with strategic opportunities for entering or exiting positions.

To further refine your trading approach, consider incorporating additional technical indicators, such as moving averages and volume analysis. This holistic method not only reinforces your trading decisions but also bolsters your confidence in navigating market fluctuations effectively. By harmonizing Fibonacci ratios with other analytical tools, you can enhance your trading strategy and achieve better outcomes.

Common Pitfalls in Using the ABC Pattern .328 1.27

While the ABC pattern .328 1.27 can be a powerful tool in trading, it’s important to recognize potential pitfalls that can undermine its effectiveness.

One major mistake is overlooking the broader market context. The ABC pattern should not be used in isolation; it functions best when considered alongside overall market trends and sentiments. Relying solely on the pattern without taking into account economic news, market movements, and trading volume can lead to misguided decisions.

Another common error is neglecting to set stop losses. In volatile markets, failing to implement stop losses can result in significant financial losses. To safeguard your trades from abrupt reversals, always place a stop loss below Point C.

Additionally, misinterpreting Fibonacci levels is a frequent issue among traders. Incorrect chart analysis can lead to erroneous identification of the .328 retracement or 1.27 extension. It’s essential to utilize precise Fibonacci tools and double-check these levels before executing trades.

To enhance your trading strategy, consider backtesting the ABC pattern to assess its historical success rate. Combining this pattern with other technical indicators can also improve accuracy and provide additional confirmation for your trading decisions. By being aware of these common mistakes and taking proactive measures, you can navigate the complexities of trading more effectively.

Understanding the .328 and 1.27 Fibonacci Levels in the ABC Pattern

The designation of “.328 1.27” refers to specific Fibonacci retracement levels that play a significant role within the ABC pattern.

The 0.328 level (32.8%) is commonly regarded as a critical retracement point for Wave B. When the price retraces to this level, it often signals a strong potential for the trend to continue following the completion of Wave B. This retracement suggests that market participants may be regrouping before pushing the price back in the direction of the prevailing trend.

On the other hand, the 1.27 level (127%) serves as a projection for the potential endpoint of Wave C. If Wave C extends beyond Wave A and reaches the 1.27 level, it indicates strong upward momentum. This movement can either suggest a continuation of the existing trend or hint at an impending reversal, making it a crucial point for traders to monitor.

By incorporating these Fibonacci levels into their analysis, traders can gain deeper insights into potential market movements, helping them make more informed trading decisions.

Utilizing the .328 1.27 Configuration in Trading

Traders leverage the .328 1.27 configuration to refine their decision-making processes in the markets. This methodology involves several key steps.

The first step is identifying the pattern. Traders scan their charts for the formation of the ABC pattern, which is characterized by the peaks and troughs that define Waves A, B, and C. Recognizing these points is essential for analyzing potential market movements.

Next, traders assess the retracement level for Wave B. After pinpointing Wave A, they measure the retracement to the 0.328 level. If the price maintains its position above this threshold, it strengthens the anticipation of a bullish trend, suggesting that the market may be poised for upward movement.

Following the confirmation of Wave B, traders turn to the extension for Wave C. They project Wave C using the 1.27 extension level. A successful breach of the previous Wave A high (in a bullish scenario) or low (in a bearish scenario) at this level can provide confirmation of the pattern’s validity and guide trading decisions.

Finally, risk management plays a crucial role in this strategy. Traders commonly implement stop-loss orders positioned just beyond the critical retracement or extension levels. This practice helps safeguard their positions against unfavorable price fluctuations, ensuring they can navigate the market with greater confidence.

By incorporating these practices, traders can enhance their ability to make informed decisions based on the .328 1.27 configuration, increasing their chances of success in the dynamic trading environment.

Final Words

In the dynamic world of trading, the ABC pattern, specifically the .328 1.27 configuration, stands out as a powerful tool for traders seeking to enhance their decision-making. This pattern involves identifying three critical points: A, B, and C, which highlight potential market reversals. The .328 Fibonacci retracement level serves as a crucial support point, indicating possible price rebounds during corrections, while the 1.27 extension level offers insight into profit-taking targets. By effectively utilizing these levels, traders can improve their market analysis and strategize their entries and exits more confidently. Integrating sound risk management practices, such as setting stop-loss orders, further strengthens the effectiveness of this approach. Mastering the ABC pattern with the .328 and 1.27 ratios equips traders with valuable insights into market dynamics, allowing for more strategic and informed trading decisions.

Stay in the loop for upcoming updates and alerts! Blog Blower