What Should You Look for in Fraud Detection Software?

Table of Contents

- Key Takeaways

- The Importance of Fraud Detection Software

- Essential Features to Consider

- Real-Time Monitoring and Alerts

- AI and Machine Learning Capabilities

- Customization and Integration with Existing Systems

- User-Friendly Interface and Reporting

- Scalability and Adaptability

- Compliance and Regulatory Support

- Cost-Effectiveness and Value

Key Takeaways

- Understanding the critical role fraud detection software plays in protecting businesses and customers.

- Identifying key features that contribute to robust fraud prevention systems.

- Learning about the importance of scalability, adaptability, and compliance in fraud detection solutions.

The Importance of Fraud Detection Software

In the digital age, protecting businesses from fraudulent activities has become paramount. Fraud detection software is essential for safeguarding financial transactions and sensitive information from cybercriminals. As online transactions grow in volume and sophistication, so do the methods employed by fraudsters. Therefore, robust fraud detection software is indispensable for any business wishing to maintain consumer trust and protect its financial health. Companies must consider several factors when choosing the right solution to ensure their systems are as secure as possible.

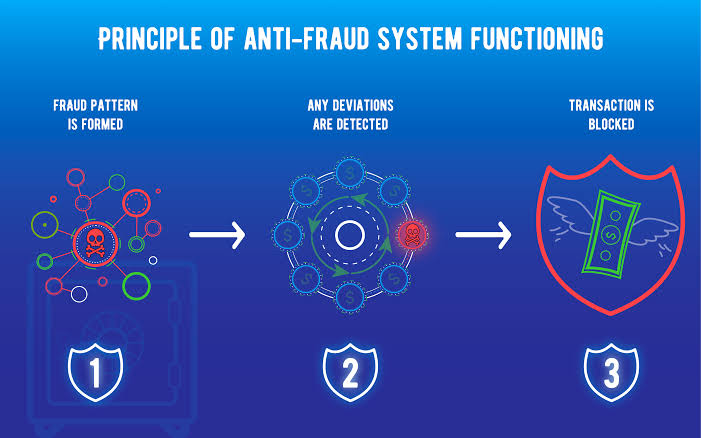

While once a nice-to-have luxury, fraud detection solutions have become crucial to enterprise-level cybersecurity strategies. They help businesses detect unusual patterns and behaviors that may indicate fraudulent activities. By offering real-time monitoring and analysis, fraud detection software can significantly reduce the risk of financial losses and reputational damage. Choosing the right fraud detection software involves understanding the features that contribute to adequate protection against scam activities.

Essential Features to Consider

Selecting fraud detection software can be daunting due to the array of options and technologies available. However, understanding the essential features required can guide businesses in making informed decisions. Top-tier fraud detection solutions often incorporate several capabilities, including real-time monitoring, AI-driven analytics, and seamless integration with existing platforms. These features enable businesses to stay ahead of fraudsters, ready to respond to sophisticated and evolving threats. In addition, the ability of software to handle increasing transaction loads, remain compliant with industry regulations, and maintain cost-effectiveness are vital considerations when selecting.

The ideal software should provide comprehensive coverage, detecting fraud types such as identity theft, transaction fraud, and account takeovers. Furthermore, the system should be capable of alerting relevant stakeholders immediately when any suspicious activity is detected. This section delves into the core features to look out for, ensuring businesses obtain the maximum benefit from their fraud detection investments.

Real-Time Monitoring and Alerts

Real-time monitoring and instant alerts are fundamental to any effective fraud detection solution. In today’s fast-paced digital environment, the ability to swiftly identify and intercept fraudulent activities can mean the difference between a thwarted scam and substantial financial loss. Real-time capabilities empower businesses to keep a vigilant eye on transactions as they occur, offering immediate scrutiny of data to identify discrepancies. This proactive approach is crucial, enabling companies to react promptly to threats and mitigate their impact.

Effective real-time monitoring should seamlessly integrate with a business’s infrastructure, providing uninterrupted oversight. Alerts should be customizable, allowing organizations to set thresholds and parameters aligning with risk tolerance levels. This ensures resources are focused on the most pressing threats, enhancing overall operational efficiency. Ultimately, real-time monitoring strengthens a company’s ability to prevent fraud, maintain the integrity of its financial operations, and preserve customer trust.

AI and Machine Learning Capabilities

With cybercrime techniques’ ever-evolving sophistication, AI and machine learning have become essential components of modern fraud detection systems. These technologies enable software to rapidly analyze vast data and identify patterns that might elude traditional rule-based systems. AI-driven solutions can evolve by learning from past incidents, enhancing their ability to anticipate and thwart future threats.

Machine learning algorithms can distinguish between normal user behaviors and anomalies suggestive of fraudulent activities. This level of adaptability allows businesses to be proactive in their fraud prevention efforts. Instead of merely reacting to threats, AI-enhanced systems can predict and prevent them, offering a dynamic defense mechanism. By leveraging these technologies, businesses gain a scalable and robust solution capable of keeping pace with the rapid advancements in cyber threats.

Customization and Integration with Existing Systems

Businesses vary in operational needs and security challenges, making customization a vital feature of fraud detection software. Tailoring the software to a company’s specific requirements can significantly enhance its effectiveness. Customizable fraud detection solutions allow businesses to adapt the software’s functionalities, rules, and alerts to match their unique risk profiles and operational structures.

Equally important is the software’s ability to integrate with and complement existing systems. An adaptable fraud detection solution should effortlessly work alongside current platforms, such as payment gateways, CRM systems, and e-commerce platforms, ensuring a unified approach to security. Seamless integration minimizes disruption and ensures all systems work harmoniously, pooling resources to present a unified defense. This harmony improves security and enhances data collection and analysis across the enterprise.

User-Friendly Interface and Reporting

A well-designed user interface makes fraud detection software more straightforward, ensuring businesses can efficiently manage and monitor fraud prevention activities. A user-friendly interface should simplify complex data presentations, providing clear visualizations and intuitive navigation that allow users to access critical information quickly. This ease of use enables staff to focus on analysis and decision-making rather than struggling with software complexities.

Additionally, comprehensive reporting capabilities are crucial for effective fraud management. Generating detailed reports allows businesses to continuously analyze past incidents, identify trends, and refine their strategies. Detailed analytics and reports help organizations understand where threats originate from, how they evolve, and how effective their current defenses are. This data-driven approach is invaluable for continuous improvement and planning in fraud prevention.

Scalability and Adaptability

As businesses grow, their transaction volumes, complexity, and risk profiles evolve, requiring scalable fraud detection solutions that can adapt to these changes. An ideal fraud detection system should accommodate fluctuating volumes without compromising performance or security. This scalability ensures continuous protection as businesses expand their operations, enter new markets, or diversify their offerings.

Additionally, adaptability to emerging threats and integration of new technologies are vital. Fraud detection software must remain flexible, capable of adjusting to new methodologies and incorporating the latest technological advancements, such as blockchain or advanced cryptography, as they become available. Companies should seek future-proof solutions, minimizing the risk of obsolescence as the digital landscape evolves.

Compliance and Regulatory Support

Navigating the complex web of regulations in financial technology and digital transactions is a critical challenge for businesses. Compliance with standards like PCI DSS, GDPR, and other regional mandates is a legal obligation and a cornerstone of secure transactions. Fraud detection software should support these compliance requirements, providing features that help businesses adhere to regulatory expectations effortlessly.

Businesses must ensure their fraud detection solution provides auditing capabilities and generates compliance-ready reports. These functionalities simplify the compliance process, reducing the burden on internal resources and ensuring businesses remain aligned with ever-evolving regulatory landscapes. A solution that aids compliance minimizes risk and enhances trust and credibility with customers and partners.

Cost-Effectiveness and Value

While safeguarding business transactions is paramount, cost is always a consideration. The best fraud detection solutions balance robust security features and affordability. A cost-effective solution should deliver value that exceeds its price, offering comprehensive protection without breaking the budget. Businesses should evaluate the total cost of ownership, considering the upfront costs and maintenance, updates, and support.

The value of fraud detection software is ultimately measured by its effectiveness in preventing fraud and its associated losses. Cost-effectiveness also entails examining the potential ROI from avoiding fraud costs, preserving business reputation, and streamlining operations. Investing in the right fraud detection software can provide long-term savings and peace of mind for a business’s financial future.